Solutions – Build

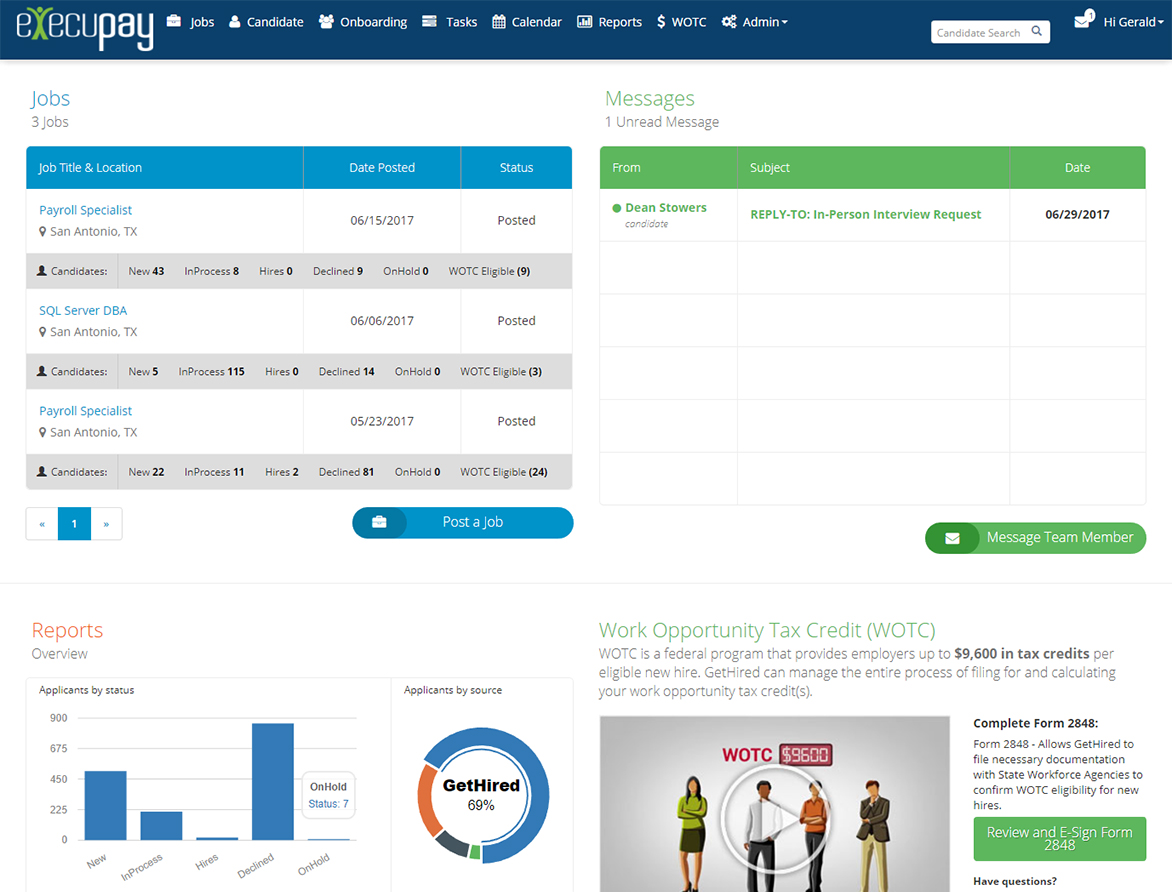

Applicant Tracking

Payrolls Inc.’s applicant tracking solutions simplify your talent acquisition process by screening, identifying, scoring and ranking candidates with pre-defined requirements through the applicant hiring process. It’s our mission to help you reach qualified candidates, gather resources for interviews and keep the administration and candidates current on the application progress.

Finding the good hires.

Payrolls Inc.’s applicant tracking solutions simplify your talent acquisition process by screening, identifying, scoring and ranking candidates with pre-defined requirements through the applicant hiring process. It’s our mission to help you reach qualified candidates, gather resources for interviews and keep the administration and candidates current on the application progress.

Finding the good hires.

Background Checks

Payrolls Inc. helps you take care of background checks quickly and easily to identify trustworthy candidates. Screenings include criminal history, education verification, professional license verification, drug use history and more. Prevent audits and penalties from I-9 violations by allowing employees to complete and store I-9s records online through Payrolls Inc.’s employment verification system.

Peace of mind.

Payrolls Inc. helps you take care of background checks quickly and easily to identify trustworthy candidates. Screenings include criminal history, education verification, professional license verification, drug use history and more. Prevent audits and penalties from I-9 violations by allowing employees to complete and store I-9s records online through Payrolls Inc.’s employment verification system.

Peace of mind.

Work Opportunity Tax Credit

Be discouraged no more, by the amount of paperwork and certification processes required for you to receive Work Opportunity Tax credits for new hires. Payrolls Inc.’s seamless and user-friendly tax credit services are 100% web-based and secure. They fulfill documents 8850 and 9061, and are finalized within the 28-day window necessary for completion.

Don’t miss out!

Be discouraged no more, by the amount of paperwork and certification processes required for you to receive Work Opportunity Tax credits for new hires. Payrolls Inc.’s seamless and user-friendly tax credit services are 100% web-based and secure. They fulfill documents 8850 and 9061, and are finalized within the 28-day window necessary for completion.

Don’t miss out!

Onboarding

Onboarding new employees is a fantastic opportunity to engage them with your team. The first few days of an employee’s transition into a new role can really get them acclimated to your company culture. Payrolls Inc.’s onboarding experience provides clear messaging and expectations, including:

It doesnt have to be a hastle.

Onboarding new employees is a fantastic opportunity to engage them with your team. The first few days of an employee’s transition into a new role can really get them acclimated to your company culture. Payrolls Inc.’s onboarding experience provides clear messaging and expectations, including:

• New-hire forms

• Employee orientation arrangements

• Internal departmental notifications

• Frequent outreach to your new hires

• Employee orientation arrangements

• Internal departmental notifications

• Frequent outreach to your new hires

It doesnt have to be a hastle.

“Payrolls Inc. Service makes running payroll so smooth and easy. They make the communication to run payroll so easy and flexible. Payroll Service offers so many products to make payroll so easy for the employees.”

– Kelly Cope, IPSecure Inc.